There will be new costs for implementing the new processes, and procrastination will almost certainly require outsourced support. Companies should consider beginning their internal assessment in early to mid-2018. In my experience, a majority of nonfinancial-asset hedgers have not adopted hedge accounting and will require additional lead time to comply with the requirements. For most investors, hedging will never come into play in their financial activities. Many investors are unlikely to trade a derivative contract at any point. Part of the reason for this is that investors with a long-term strategy, such as individuals saving for retirement, tend to ignore the day-to-day fluctuations of a given security.

The primary purpose of cash flow hedge accounting is to link the income statement recognition of a hedging instrument and a hedged transaction, whose changes in cash flows are expected to offset each other. This reclassification is reported in the same income statement line item in which the hedged transaction is reported. However, a reporting entity could potentially use a natural gas derivative as a cash flow hedge of the entire forecasted purchase or sale of power. This hedging relationship may be highly effective in circumstances where power prices are highly correlated to natural gas.

What is Hedge Accounting Example?

purchase journal might think that because they don’t use hedge accounting, the update doesn’t affect them. That’s a misperception that could send them scrambling once their external audit firm points out that disclosure tables and income-statement geography has changed. Internal processes around financial-statement reporting for derivatives will have to change to create the necessary new tables, XBRL tags, and updated descriptions of risk-management objectives.

Agrify Stock Dips After Accounting Errors Are Discovered In … – Benzinga

Agrify Stock Dips After Accounting Errors Are Discovered In ….

Posted: Fri, 21 Apr 2023 15:55:33 GMT [source]

Companies that invest in the stock market don’t want to lose money on those investments, so they buy “put options” to protect themselves. Tallying those as separate line items from the equities would double the length of the income statement and show heavy volatility if charted. In the 1990s, the Financial Accounting Standards Board moved to increase transparency in corporate financials by requiring derivatives to be measured at fair market value as assets or liabilities on companies’ balance sheets. FAS 133, the accounting standard that requires this reporting, went into effect in 2000. 1 There is a simplified approach available for certain private company hedging relationships that results in measurement of a derivative at settlement value if certain criteria are met. If the U.S.-based company were able to do the currency exchange instantly at a constant exchange rate, there would be no need to deploy a hedge.

Hedge accounting uses equity/derivatives which we shall learn more about. Put options are bought by companies that invest in the stock market to protect themselves from losses. If those were counted separately from the equity, the income statement would be twice as long and would show a high degree of volatility.

For investors who fall into the buy-and-hold category, there may seem to be little to no reason to learn about hedging at all. Do the benefits of a particular strategy outweigh the added expense it requires? Because hedging will rarely if ever result in an investor making money, it’s worth remembering that a successful hedge is one that only prevents losses. The variance of the monthly changes in the Houston Ship Channel spot price for the 24-month period is 1.48.

How Does Hedge Accounting Work?

In October 2012, Guava Gas Company enters into a cash flow hedge of the sale of the first 10,000 MMBtus of natural gas per month in each of January through March 2013. The probability of the forecasted transaction was supported by GGC’s current forecast, for which it had performed backtesting of its accuracy. GGC has also met all of the other requirements for cash flow hedge accounting. This section addresses specific issues encountered by utilities and power companies related to cash flow hedging for commodities.

180 Wealth Advisors LLC Invests $207000 in Dynatrace, Inc. (NYSE … – MarketBeat

180 Wealth Advisors LLC Invests $207000 in Dynatrace, Inc. (NYSE ….

Posted: Sat, 22 Apr 2023 11:13:22 GMT [source]

These companies must consider using the risk-component hedging provided for in the updated standard . For companies already applying hedge accounting, the benefits of simplifying their reporting and administrative burden will still carry the cost of changing their reporting to remove ineffectiveness, updating income statement reporting, and updating their disclosures. The cost and burden of early adoption will depend on available resources, given a number of other ongoing accounting standard updates, such as those for revenue recognition and lease accounting. A net investment hedge is used to hedge a company’s foreign currency exposure and reduce the potential reported earnings risk that may occur upon the future disposition of a net investment in a foreign operation. “Most derivatives are economic hedges, which entities enter into for risk management rather than speculative purposes,” Goswami said. “There is a distinction between an economic hedge and an accounting hedge, and ASC Topic 815 has specific and complex guidance on when an economic hedge can be treated as an accounting hedge.”

The change in expected cash flows on the forecasted transaction is based on the forward price for the commodity. Concurrent designation and documentation of a hedge is critical; without it, an entity could retroactively identify a hedged item, a hedged transaction, or a method of measuring effectiveness to achieve a desired accounting result. Question DH 11-1 asks if an entity can use the simplified hedge accounting approach if it is not a public business entity itself, but is a subsidiary of a public business entity.

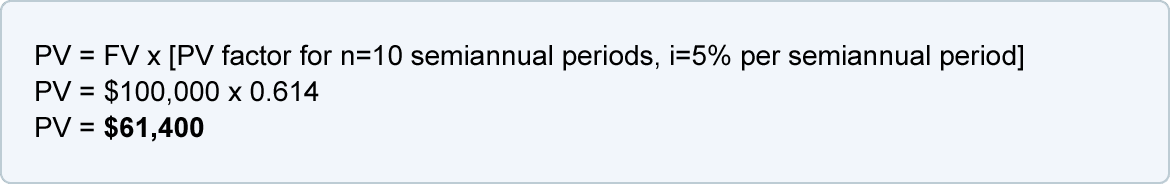

Hedge accounting 101

Regression analysis—Performing a regression of daily versus monthly prices using a complete set of data or the 30 most recent observable prices, as well as using outlier prices from certain periods (e.g., if a major weather event has caused unusual, large swings in pricing). At a high level, there are three methods of evaluating effectiveness, as highlighted in Figure 3-14. The transaction is specifically identified as either a single transaction or group of transactions. We believe the discount rate used in the present value calculation may either be the current market rate of interest adjusted for credit risk or the appropriate current risk free/benchmark rate. The notional amount of the swap matches the principal amount of the borrowing being hedged. In complying with this condition, the amount of the borrowing being hedged may be less than the total principal amount of the borrowing.

This accounting applies to anything being hedged, such as foreign exchange positions, cash flows, and interest rates. A fair value hedge is used to hedge against a company’s exposure to volatility and changes in the fair value of an asset or liability. In order to qualify for hedge accounting, the potential changes in the asset or liability’s fair value must have the potential to affect the company’s reported earnings. Examples of items that may qualify for fair value hedging include inventory and assets or liabilities denominated in a foreign currency. Formal designation and documentation of the risk management objective and strategy for undertaking the hedge, the hedging instruments and hedged items, the nature of the risk, and how the hedge effectiveness requirements are met.

Though there would be detailed initial assessments, disclosures, risk management assessment, financial impact assessment, and data requirements, it would help is to attain the real value of the information. This article offers implementation guidance, shedding light on the pitfalls of procrastination and providing direction on early adoption, internal decision-making, and key items to consider for hedgers of non-financial assets. Certain non-derivative financial assets or non-derivative financial liabilities. To de-hedge is to remove an existing position that acts as a hedge against a primary position in the market.

2 Simplified hedge accounting approach

Although the forecasted purchases occur within the same month, there is a difference in maturity date between the hedging instrument and the forecasted transaction . The difference in maturity date and the difference in the settlement index will create ineffectiveness in the hedging relationship. The assessment should be updated quarterly; however, subsequent assessments can be limited to confirming that there have been no changes to the terms of the hedging instrument and forecasted transaction, as well as an updated analysis of potential for counterparty default.

Bailard Inc. Purchases Shares of 6874 StoneX Group Inc. (NASDAQ … – MarketBeat

Bailard Inc. Purchases Shares of 6874 StoneX Group Inc. (NASDAQ ….

Posted: Sat, 22 Apr 2023 11:33:28 GMT [source]

This eliminates any chances of taking a loss on that currency if the exchange rate declines. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients.

These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license. On December 31, 2019, the share price turned out to be $ 8 each, and the market index moves to $ 5 each. The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. And while these standards are relatively new, many companies have been slow to adopt them. For companies considering early adoption, it is recommended that deliberations covering all the interim periods of 2018 begin no later than January.

What Is Hedge Accounting?

In addition, IPP believes it is remote that it will purchase more than 10,000 MMBtus of natural gas in March through June 2015, therefore determining that it is probable its forecasted transaction will not occur. For example, some markets in recent years have increased the specificity of pricing by moving from nodal pricing to locational marginal pricing. In addition, a hedging derivative or normal purchases and normal sales contract designated as the hedged item could specify the substitution of a pricing point or index to be used in the event the pricing index specified in the contract is no longer available. In general, we would not expect a group including more than one commodity or different pricing structures (e.g., monthly, daily) to qualify for designation as the hedged item, because the forecasted transactions would not qualify under the similar asset test.

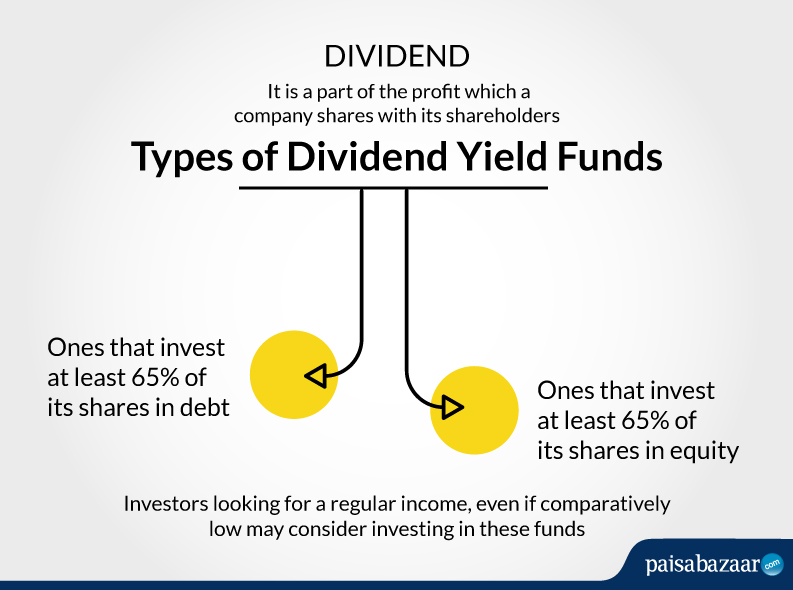

With hedge accounting, the asset and the hedge are listed together as a single line item. The two are compared against each other and the cumulative gain/loss is then recorded in financial reports. This minimizes the appearance of volatility in financial planning and analysis. It also lowers the chances of heavy losses showing up on your balance sheet. In investment circles, the term “hedge fund” is used to describe a financial vehicle that can offset market volatility.

Current/noncurrent debt classification: IFRS® Standards vs US GAAP

Two derivatives (i.e., a futures contract and a basis swap) can be used together to hedge a forecasted sale or purchase. A reporting entity may use this strategy if the forecasted transaction will occur at a location for which there is no stand-alone index (e.g., hedging a forecasted transaction at Houston Ship Channel with a NYMEX future priced based on Henry Hub). The futures contract would be used to fix the price of natural gas and the basis swap would be used to bridge the two indices (i.e., from the NYMEX future to the actual location of the forecasted transaction, in this case Houston Ship Channel). However, as long as the parent and subsidiary have the same functional currency, a subsidiary can apply hedge accounting to a hedge of a forecasted intercompany transaction in its stand-alone financial statements. At the subsidiary reporting level, that transaction is with an external party. See DH 9.1.2 for further information on discontinuation of cash flow hedges.

The income statement and the balance sheet are much easily understandable once the accountants have put the pieces together. Accounting methods to reconcile these differences are called hedge accounting. The two entries, the fair value, and the opposing hedge are treated as one. Hedge accounting is a proven way to minimize the volatility on your balance sheet and track investments and derivatives.

- In the important financial reports, hedge accounting is the best way to summarize and account for these important yet uncertain values.

- If the hedging relationship does not qualify for hedge accounting, DH Corp would reflect changes in the fair value of the swap in earnings each reporting period.

- The elimination or reduced liquidity of trading points may result in such points no longer having a risk profile that correlates with the original hedged transaction.

- The two entries, the fair value, and the opposing hedge are treated as one.

A net investment hedge is a cash flow hedge specific to foreign currency. The hedging instrument can be a derivative, like a futures contract, or a non-derivative, such as the purchase of foreign currency-denominated debt. Accountants should research this type of hedge thoroughly before applying it. Hedge accounting involves offsetting changes in the fair value of a financial instrument with changes in the fair value of a paired hedge. Hedges are used to reduce the risk of losses by taking on an offsetting position in relation to a financial instrument. The result tends to be relatively modest ongoing changes in the reported fair value of financial instruments.

However, companies are also more likely to be eligible for credit if they meet certain banking covenants (which may include having a stable P&L). In the case of privately held firms, accurate forecasting and reporting are also essential so as to avoid nasty surprises – which also serves to keep investors and other stakeholders on-board. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.